What is Susu?

A type of informal savings and credit club arrangement between a small group of people who take turns “throwing hands.” Coined “Susu” in West Africa and the Caribbean, other cultures refer to this as a “Tanda”, “Chit fund” or a ROSCA (rotating savings and credit association). Susu is short for “asociación,” the Spanish word for the association.

The Struggle for Financial Inclusion

an

Immigrant's

Story

an

Immigrant's

Story

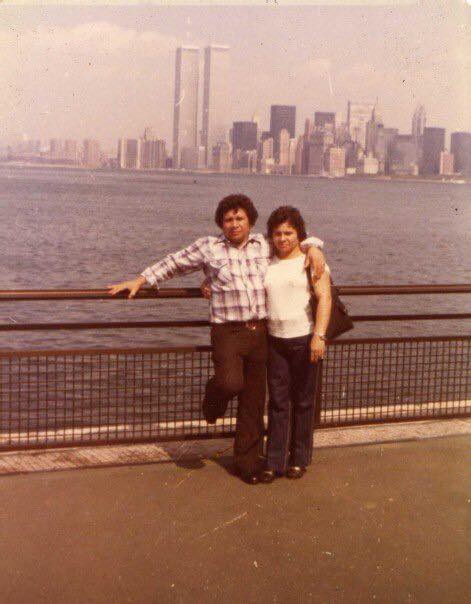

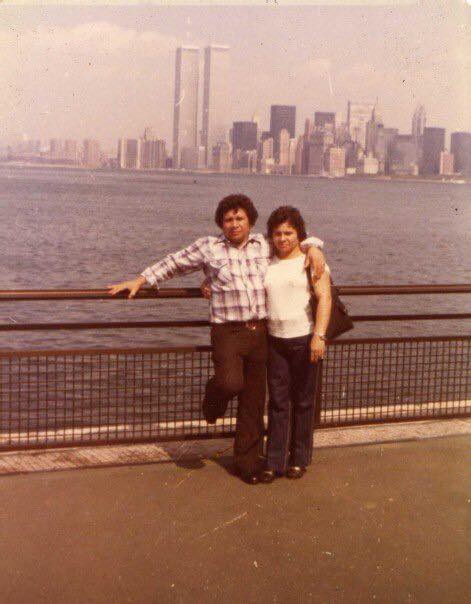

The story of Susu Lend is deeply rooted in the personal experiences of our founder, Pedro. His father, an immigrant to the United States, found employment as a janitor at the iconic World Trade Center. Even with a stable source of income, he was not immune to the challenges many immigrants face, especially when seeking financial assistance. Confronted with loan denials during critical times of need, he turned to the age-old practice of forming a “susu” – a collective saving and borrowing system among friends and family. This resilient approach to financial adversity laid the foundation for what Susu Lend represents today: a mission to make financial inclusion accessible for all.

Susu Lend's Mission

Susu Lend is a financial technology company founded on one simple principle: everyone deserves a fairly priced lending product. Thanks to our proprietary underwriting models, we offer customers an alternative to predatory lending with loans powered by a personal social network of trust.

We envision a society where everyone, regardless of socioeconomic status or race, has access to fair and affordable financial services. For too long immigrants and marginalized communities have been neglected and exploited by the traditional banking system. Predatory and discriminatory practices have led to generational poverty and distrust of financial institutions. Susu Lend was founded to provide an honest banking experience to build wealth in our community. Based on the pillars of trust and transparency, Susu Lend will provide low-cost loans and banking services designed to strengthen our customer’s financial stability – not prey on it. Susu Lend is committed to changing the way we bank in America, so that everyone can achieve financial freedom.

Unlocking Prosperity with

The Susu Flower

The chrysanthemum has significant cultural reference for many cultures across the globe. To many, the chrysanthemum flower, or simply mum, represents positivity, good fortune and luck.

![]()

Global Roots, Local Blooms

At Susu Lend, the chrysanthemum mirrors our vision of sowing seeds of financial prosperity and blooming hope within our communities. Our ethos is deeply rooted in recognizing and honoring the varied, rich financial narratives that permeate diverse communities. Like the myriad of mums blossoming across the world, we adapt and tailor our financial solutions, acknowledging the distinct needs and aspirations that exist within every individual and community we serve.

Financial Community

A caring financial community to help you reach your goals

We built Susu to help build you up. Because every dollar that we keep out of a payday lender’s wallet is another dollar spent in our community.